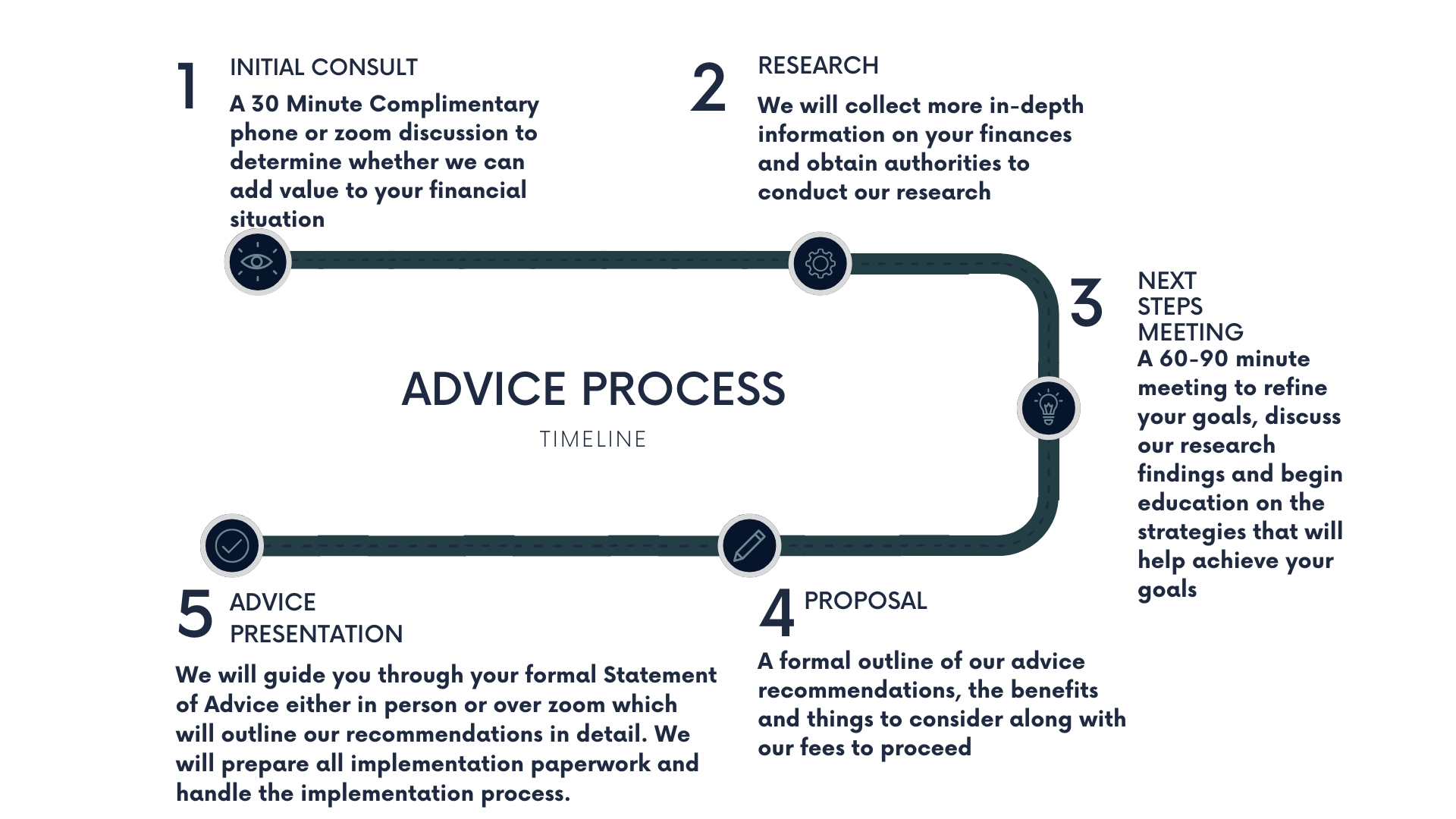

Start Your Journey

Our 5 easy steps for getting Financial Advice

What We Do

Retirement Planning

Our skilled team evaluates your financial position and creates custom strategies to plan out your retirement. We guide you on when you can retire and what your financial status will look like post-retirement, ensuring you have all the details needed to make informed financial decisions. After retirement, we continue to monitor your finances closely to make sure you’re getting the most out of your well-earned retirement while we handle the details to help you relax and live stress-free.

Cashflow and Debt Mangement

Your cashflow is the lifeblood of your financial health. But it can be hard to know exactly where you stand and how to make it work to your advantage. That’s where we come in. We’ll dive deep into your finances, assess your cashflow, and give you practical advice on how to maximise your financial potential. With our help, you’ll be able to take control of your financial future and achieve real success.

Investment Advice and Structure

Picture this: you’ve worked hard to build up your wealth and assets, but now you’re not sure how to structure it all. That’s where we come in. We have a keen eye for the big picture and can help you plan your investments accordingly. Whether it’s investing in your name, or setting up a family trust or company, we’ll guide you towards the best option for asset protection and tax efficiency.

Superannuation and SMSF

Are you feeling overwhelmed about choosing a super fund? It’s no wonder – there are so many options out there! But don’t worry, we’re here to make the process easier for you. Our team will carefully evaluate your current super fund to determine if it’s the right fit for your needs. Plus, we’ll handle all of your investments and offer advice on contributions that can boost your tax savings. Let us take the stress out of superannuation so you can focus on the things that matter most. Additionally, our team have over a decade of combined experience with managing Self-Managed Super Funds.

Wealth Protection

Keep your family’s future secure with our expert Wealth Protection services. Our knowledgeable team evaluate your unique situation to determine the best insurance coverage to shield your family from potential financial hardships. With our guidance, you can rest assured that you and your loved ones are protected from life’s uncertainties.

Tax Planning

Looking to keep more of your hard-earned money in your pocket? Look no further! Our expert team can help with strategies to reduce your tax burden and maximise your overall wealth position.

What Our Clients Say